Acquisition & Divestment

Asset Planning & Management

Business Strategy & Transformation

Data, Analytics & AI

Enterprise Technology

Operational Technology Services

Operational Technology Services

Trending

What We Do

Industries

Solutions

Service Feature

1898 & Co. ESG Consulting for Transparency in Complex Transactions

Environmental stewardship, social impact and climate change are among the most significant issues of our time. Environmental, social and governance (ESG) evaluations will support lenders and investors — helping them understand these complex issues — while increasing transparency and accountability in projects and transactions.

Environmental stewardship, social impact and climate change are among the most significant issues of our time. Environmental, social and governance (ESG) evaluations will support lenders and investors — helping them understand these complex issues — while increasing transparency and accountability in projects and transactions.

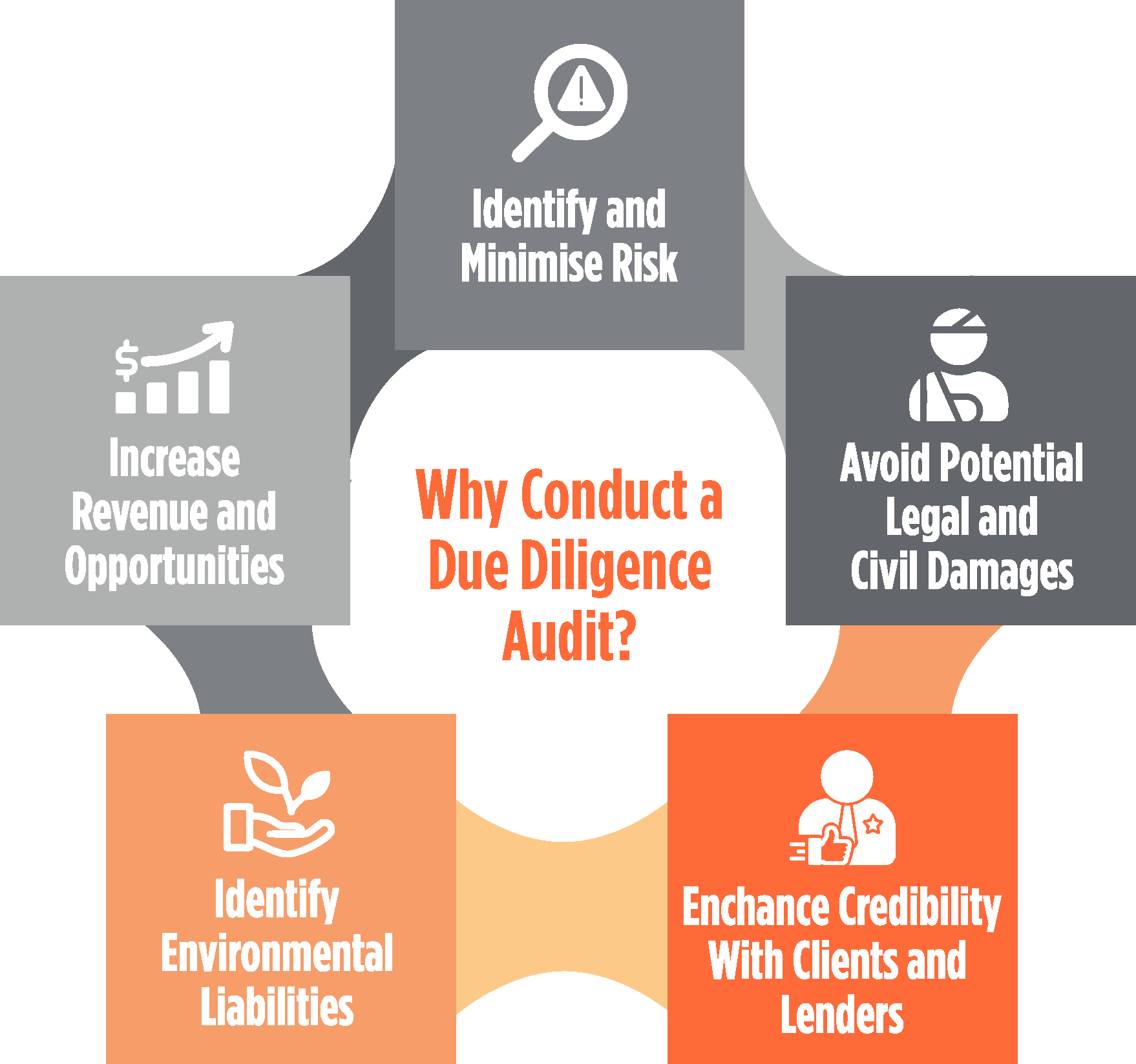

Investors and lenders are required to make informed investment decisions, and can be accountable for responsible investment. An experienced ESG due diligence and transactions advisor can provide an understanding of:

All companies are susceptible to the costs and liabilities of environmental and social risk when undertaking mergers and acquisitions (M&A). Lenders and investors are factoring ESG risk into their decision-making process, increasing confidence by improving risk management and market transparency. By identifying and quantifying ESG risk, and the process by which it is being managed, lenders and investors can gain an enhanced view of corporate risk and strengthen their investment appraisals and due diligence process.

1898 & Co. ESG Consulting takes a risk-based approach in analysing ESG factors during transactions across many sectors. With in-depth global experience, we have assisted many lender and investor clients with successful business transactions in a sustainable and informed way.

Our consultants provide depth of experience across many sectors and regulatory regions. Many also have operational experience, leveraging specialist knowledge, opinions and innovative solutions for the clients’ benefit. Environmental and social transaction advisory capabilities include:

Transparency and accountability are important to helping your transactions move forward and evaluation through an ESG lens can be one critical factor for success.

✖

Cool Video Headline Goes Here

Video Column Complete

video description goes here. video description goes here

✖