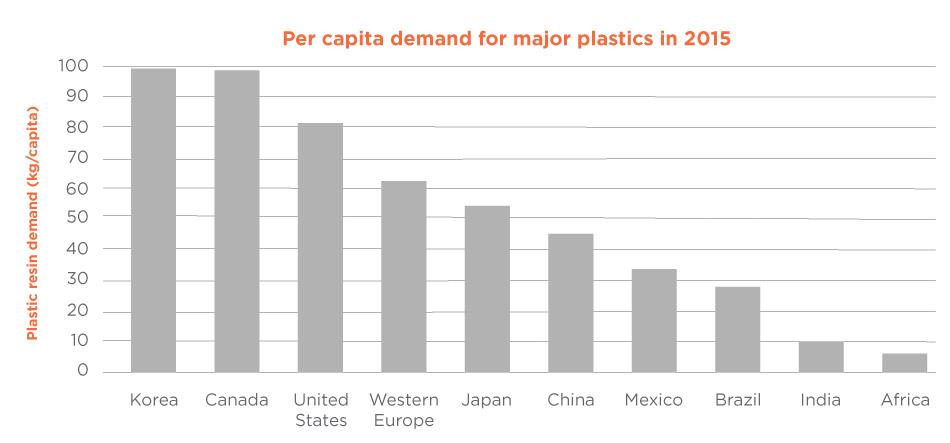

The oil and gas market continues to be incredibly competitive. This is because almost all finished products are fungible, and there is very little difference in end product or quality. These products are easily transportable across the globe. This means that organizations that exhibit competitive advantages in certain geographical sectors can take advantage of growth in other geographies. For these reasons, organizations must continue to consider new production or complexes, and to approach them from a financially focused standpoint.

It is expected that most of the new grassroots oil-to-chemicals complexes will be built in parts of the world where crude oil is bountiful and close to the regions experiencing the highest demand growth. This includes the Middle East and Asia, including Southeast Asia. Generally, these complexes are built to leverage economies of scale while pushing the bounds of proven train capacity for both refining and petrochemical units.

There are many ways to build and focus new oil-to-chemicals complexes — there are literally hundreds of different configurations. If a producer started out with a blank sheet of paper, there would be no way to know what the right configuration would be for the business plan or market. Organizations must go through a configuration development process to maximize the value of each stream. This will present the configuration that suits the organization’s needs.

An oil-to-chemicals complex requires a series of traditional refining steps to prepare the oil fractions for conversion to petrochemicals. Generally, this results in a highly complex refinery configuration with significant levels of conversion. Many processes exist to convert oil fractions directly to some petrochemical products — and these processes will be heavily favored during the configuration of an oil-to-chemicals complex as they reduce the steps from oil to petrochemicals, saving capital and operational expenditure. One such example is a high-olefin FCC process, which can produce significant quantities of propylene and butylene.

There are steps a development partner can perform to maximize the internal rate of return (IRR) of the organization’s investment on a new facility. Net present value can be somewhat misleading when options of varying capital spend are compared. Thus, IRR or profitability index (profitability relative to capital spend via net present value) are used to measure or rank different configurations.

Depending on the price set and market demand, as the conversion from fuels to petrochemical products increases, IRR will generally increase. However, at some point, the maximum value of all streams in the plant are achieved, striking a balance between transportation fuels and petrochemical production. In this scenario, further increase of petrochemical production will begin to erode the complex’s value. Methodologies can be applied to determine this maximum point to find the most productive configuration.